|

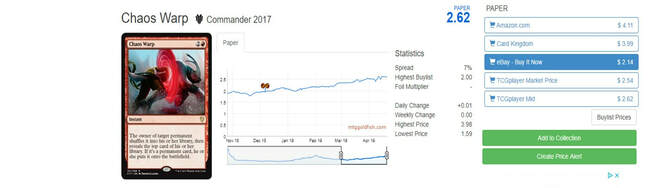

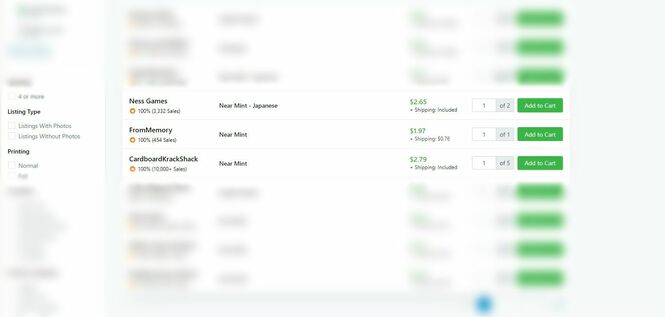

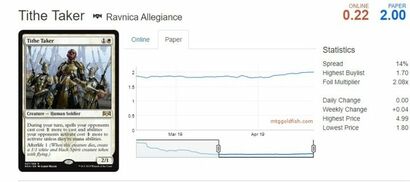

Card rarities in Magic: The Gathering comprise common, uncommon, rare, and mythic. Typically, each pack of cards contains ten commons, three uncommon, and one rare or mythic. Over time, players accumulate piles of commons and uncommon ones deemed unplayable in most formats of the game. These piles of extra cards are called bulk cards. Players often sell local gaming stores (LGS) a mix of 1,000 commons and uncommon (bulk) for $3.00 to $5.00 in-store credit or cash. An LGS will either organize the bulk cards for single selling or re-sell them at a higher price. For example, one of my LGS buys 1,000 bulk cards for $3.00 in-store credit. They will then sell a bundle box quantity (about 550 cards) of unsorted bulk for $5.00. Why Pick Bulk? Sifting through bulk cards is a time-consuming process. However, there is an incentive for players to look through bulk boxes. An LGS may buy a collection of cards from a player but not have the time to go through every card box. Unchecked boxes can end up on shelves for players to look through. There are many common and uncommon MTG worth multiple dollars. My favorite website to view valuable bulk cards by set is MTG Dawnglare. You can search by format or set to find common and uncommon cards worth over $1.00. Newer sets may contain valuable cards that players overlook. For example, Reliquary Tower from Core 2019 sells for about $3.00. You can buylist Reliquary Tower from a vendor for $1.50 each. Finding just four copies of Reliquary Tower will offset the $5.00 spent on 546 other cards. A few decent pulls from an unsorted box will allow you to keep the rest of the cards for essentially free. Any value gained from the remaining bulk cards can net a profit. Beyond earning a profit, some players pick bulk because they want to build their card collection. It is much cheaper paying $0.01 per card in the example above than buying a single common and uncommon for $0.10 or more. Your time spent picking bulk can save money by acquiring cards you want at a discount. Players interested in the Pauper or Elder Dragon Highlander (EDH) formats may find bulk picking an excellent opportunity to save money.  Reserved List pulls from bulk Reserved List pulls from bulk My Tips for Effective Bulk Picking 1. Knowledge of the Most Played Commons and Uncommon in Constructed Formats Part of successfully picking bulk is knowing what you should pull out of a card box. The most played cards are usually worth more than others of similar rarities. A great place to start is with MTGGoldfish's format staple lists. To maximize value, I would focus on the Modern and Legacy card lists. I have found better returns on older cards than most Standard-legal commons and uncommon. 2. Knowledge of the Most Played EDH Cards by Color EDH is a popular format with a huge card pool. EDHREC has top played card lists by color, artifact, and land. I recommend grabbing guild signets, tri-color lands, and blue cards as a starting point. It would help if you also familiarize yourself with the list of top commanders. This list will help you focus on gold cards that share multiple colors. Currently, I have found Gruul (red and green) as the least popular color combination. 3. Reference a Buylist or MTG Dawnglare When Picking Bulk It is beneficial to pull up a vendor buylist or MTG Dawnglare when picking through bulk. I like to sort prices by MTG set on vendor buylists to see what cards are worth money. I try to take cards that will generate $0.08 or higher in-store credit. Otherwise, I believe the return is not worth the time and effort after shipping costs. Also, I use MTG Dawnglare to see a list of valuable cards by set quickly. If I come across an MTG set with no commons and uncommon worth over $1.00, I will skip it entirely. For example, Theros only has Burnished Hart and Grey Merchant of Asphodel that I would consider pulling. Instead of spending time going through a box of Theros, I will skip it and move on to another set. I use this strategy for MTG sets that have valuable cards in one color. Avacyn Restored has one valuable uncommon called Blood Artist. If I come across this set, I will only look at the black cards. 4. Focus on Uncommon Rarity Symbols Every MTG set beginning with Exodus uses colored rarity set symbols on cards. Commons cards are black and uncommon cards are silver. When sorting cards, I recommend looking for uncommon Silver cards. I generally skip through all common unless I recognize the artwork or the card name. The reason for doing this is because very few common cards hold value. It is a waste of time trying to look at every single card in a box. An exception to this rule is when I come across old sets like Zendikar, Fifth Dawn, and Dissension. Common cards can be worth a few dollars from these sets. I will also take my time looking through Modern Masters sets. 5. Make Piles of Cards From Sets Without Rarity Symbols It is hard for most players to remember the rarities of cards from sets like Fourth Edition, Ice Age, and Visions. These sets do not contain rarity symbols on the cards. Some players overlook this trait and put rare cards in their bulk boxes. I strongly encourage you to set cards aside from these sets and check their values. Once you get a good-sized stack, you can quickly reference a vendor buylist or MTG Dawnglare. I often find valuable cards, including Reserved List cards, in bulk boxes from sets before Exodus. 6. Take Cards You Want to Play for Personal Use If you enjoy playing MTG and want to build a personal collection, you should take cards to keep. I take cards for EDH and older formats that are popular with players. When I recently came across a bulk box of Zendikar commons, I set aside copies of Expedition Map and Journey to Nowhere for personal use. I keep around 15% of my bulk box pulls for playing in various MTG formats. 7. Know Shipping Costs When Buylisting Bulk to Online Vendors It would help if you had a good gauge for the cost of mailing bulk cards to online vendors. A Reddit user reminded me that USPS offers small flat rate Priority Mail boxes. These boxes hold around 400 cards regardless of weight. You can send an entire package of bulk across the country to an online vendor for about $0.02 a card with a Priority Mail small flat rate box. Picking bulk can be a profitable and rewarding way to build your MTG card collection. I believe setting thresholds and knowing what to pull will improve your efficiency and profitability. Keep in mind that your time has a value attached to it. Some may find picking bulk to be worth the effort to supplement MTG spending. Others may like the experience of finding valuable cards in a box of 3,000 cards. I enjoy looking through old cards and finding new options for EDH decks. Whatever your reason is for looking through bulk, I hope my tips improve your next picking experience. To view the other posts in this 3-part series on MTG finance speculation, click the links below: Magic: The Gathering Finance Part 1: An Introduction and Analytical Test for Speculating Magic: The Gathering Finance Part 2: Analyzing Speculation Targets and Lowering Costs I originally bought $188.11 of Magic: The Gathering cards in April as a speculation test. I have currently sold about 56% of my speculated cards as of May 31st, 2019. Here is a link to my updated speculation spreadsheet. I added a key tab to understand better how to interpret the data. I have sold or buylisted several cards due to price increases, price spikes, and price stagnation. When buylisting, I divided shipping fees across all cards mailed to Card Kingdom in Seattle, Washington. While I have made money thus far, I also lost money on a few cards. Overall, my current net profit is $26.12, or a 20% return. I will cover some of the hits, misses, and observations during the first eight weeks of this speculation test.  Pricing graph from MTG Goldfish Pricing graph from MTG Goldfish Hits Tithe Taker was bought at an average price of $1.06 and buylisted at a net price of $1.71. This 62% ($1.96) profit gain happened due to its steady growth and new demand from the Unified Assault challenger deck. I covered my analysis and decisions on this card in the previous article. After selling the Tithe Takers, the buylist price rose to $2.00 each as of May 7th, 2019. I also correctly called Unbreakable Formation increasing in value. The buylist price for foils rose from $0.33 to $0.99 in three weeks. Unfortunately, I paid too much and sold the copy at a slight loss. While I thought this card hit a price ceiling, the buylist price increased to $1.25 as of May 7th, 2019. It is easy to get upset knowing you could have made more money. However, cashing out for a considerable profit is not bad as card prices can quickly decrease for buylists. Guardian Project was another successful speculation. I saw people talking about the power of this card in Elder Dragon Highlander. I also watched the price move from $0.35 to $0.75 in two weeks. On May 7th, 2019, copies were selling on TCGPlayer for an average price of $1.44. I saw foil copies selling fast on TCGPlayer and Card Kingdom with a low multiplier. I bought a foil copy for $3.15 due to the rising EDH popularity and buylisted a few weeks later at $4.45. Guardian Project returned a profit of 41%, or $1.30. This card would have also been an excellent bulk buy at $0.50. Current copies of non-foils are buylisting for about $0.80 each. I would not attempt to buy deep into non-foils now. However, it may be an excellent opportunity to purchase cheap foils for a long-term hold.  Pricing Graph from MTG Goldfish Pricing Graph from MTG Goldfish Queen Marchesa was a massive win off of a promotional opportunity. There was a Google Express promotion for 20% off your first order in April. I purchased multiple copies Queen Marchesa the day after it spiked to $17.10 each. I thought Queen Marchesa was going to be an easy flip. However, the buylist price quickly dropped from $24.00 to $17.25 as other people dumped their stock. The prices on eBay and TCGPlayer began dropping steadily down to around $28.00. It became apparent that the demand for this card was inherently low. I listed the copies on eBay for $27.99 each and ultimately sold all three for a net profit of 31% or $15.83. I purchased four copies of Lux Cannon during the same Google Express promotion at a discounted price of $5.09 each. I patiently waited to sell them as prices rose from $9.00 to $10.00 over a month. I tried selling the set on eBay for $36.99 but had no luck. Finally, I buylisted each copy at a net price of $6.35. I was able to make a profit of 25% or $5.06 from the set. I learned that it is hard to sell EDH cards as a set of four when players need one copy. There was an opportunity to sell each card on eBay for a maximum net price of about $7.25. However, I decided to accept the buylist price of $6.35 instead of taking the risk of mailing without tracking. Misses The most significant losses came from cards that had a high buylist spread. Such cards included Rhythm of the Wild, Sheltered Thicket, and Unbreakable Formation. While two of them did increase in price, the spread was not enough to recoup my initial investment. The other issue with these cards is that I cannot sell them on eBay or another platform for a reasonable profit. The price of each card is too low to sell outside of a face-to-face transaction. My only outlet to deal with the cards was by buylisting at my local store or an online vendor. I would caution against buying cards where the current buylist price, including a store credit option, is not enough to cover your costs. Another miss was selling the Gilded Lotus and Goblin Bombardment too early. I had flagged these cards as long-term holds but sold them a month after purchasing. I grew impatient that the card prices were not rising. Unfortunately, their prices increased a week after I buylisted them. Had I stuck to my original strategy, I would have doubled my total profits on Goblin Bombardment and Gilded Lotus. I recommend being patient when speculating on EDH staples and not try to flip them for a profit immediately. Observations A card's buylist spread heavily influences the likelihood of earning a profit from a short-term hold. The closer my purchase price of a card is to its buylist price, the higher the chance I can make a profit. I have done well-flipping arbitrage opportunities and Standard cards. Many EDH speculations appreciated over time, but not all reached an ideal price point. I will look to move some of them in June after a 60-day holding period. It appears that cards purchased with a high buylist spread, like Skyline Despot and Grafdigger's Cage, will not return a profit. The growth and demand for these cards are slow due to their limited EDH and sideboard use. There will probably be an opportunity in six to eight months where I can break even. If they reach a price point where I can break even by taking store credit, I may buylist them. Regarding buylisting, I have been fortunate enough to mail my speculations with cards from my collection to spread out shipping costs. Thanks to pooling cards together, the average price per card shipped across the United States has been $0.51. A negative consequence of buying inexpensive cards is the limited avenues of selling them for a profit. I either have to buylist cheap cards from a store, sell them in person, or trade them for other cards. It would make more sense in the future to buy larger quantities of low-priced cards to ship together or sell sets on eBay. In addition, it was more time-consuming selling three cards over $25.00 on eBay than buylisting, organizing, and sending many inexpensive cards to one vendor. I want to highlight another topic of MTG card speculation. The condition of a card is critical when determining a card's selling price. Players and vendors can typically agree to a price for a near-mint condition of a card. However, opinions start to change when discussing the price of a card with light play or heavy play wear. Some players are only interested in near-mint cards, while others are less concerned. Many vendors tell you in advance how much discounting they will take-off of a buylist price for cards that are not near mint. I have been very particular about the conditions of cards purchased as speculation targets, especially foil versions. I also bought some cards with light play wear that arrived as near-mint. However, I recommend speculating only on near-mint copies of cards since it is a universal price point among players and vendors. I may not have as much success selling the rest of my speculations, but I am pleased with my profit and performance thus far. If you are interested in other MTG finance topics, I recommend reading my posts on self-fulling prophecies and buying bulk for profitable returns. *The information in this article is my knowledge and opinion and is meant for informational purposes only. I am not a registered financial professional or trying to act as one.* To view the other posts in this 3-part series on MTG finance speculation, click the links below: Magic: The Gathering Finance Part 1: An Introduction and Analytical Test for Speculating Magic: The Gathering Finance Part 3: Speculation Hits and Misses After 8 Weeks Forecasting the price movement of a specific trading card is not a simple task. Business professionals use forecasting models, historical pricing, and qualitative information to make assumptions about the future. Graduate school taught me that a blended forecasting approach is better than using one singular method. While you may not have access to professional forecasting software, there are accessible sources of information about Magic: The Gathering. This information can help you forecast future price movements for MTG card speculating. I am currently running a test on speculating MTG cards, which are available in this spreadsheet. MTG Stocks I like using MTG Stocks to see historical pricing movement, recent price spikes, and track speculations. You can create a free account to watch cards, inventory your speculations, and view the most commonly played cards by format. They have interactive graphs showing price movement over time. MTG Goldfish Another great resource is MTG Goldfish. They also provide graphs of price movement over time. However, the essential information they offer are spreads and buylist prices. I highly encourage you to read this article on MTG Goldfish that explains the metrics available. The format staple lists on MTG Goldfish can help you understand the demand for certain cards across multiple constructed formats. I like reviewing these lists for speculation targets with slow to medium growth potential. MTG Goldfish regularly updates its front page when there are product announcements and spoilers for new cards. eBay Sold Listings Before I purchase a card for speculating, I always check its previous sale prices on eBay. On eBay, you can search for a specific card and filter to sold listings. You should review the conditions and previous prices paid to understand a realistic sale price. I compare the sold eBay pricing with buylists to better understand the spread and demand. EDHREC EDHREC is an excellent source for understanding the general demand of Elder Dragon Highlander (Commander) cards. When speculating on EDH cards, I recommend looking at how many decks a card is listed. Also, check if a card is a recommended option for the most popular commanders. For my speculation test, I looked at cards in 8,000 or more decks. You can consider cards in fewer decks as well. Vendor Buylists Generally speaking, vendors offer about 50% of a card's market value as a cash payment. For cards higher in demand, they may offer cash prices between 60% and 75% of their market value. For example, Card Kingdom offered $10.00 cash for a Guilds of Ravnica Watery Grave on April 20th, 2019. Their sale price for the card was $14.99. The cash buylist price is 67% of their retail price. I like cards with high buylist ratios because it allows me to liquidate closer to my initial investment amount. In addition, the buylist acts as a safety net against my speculations. I can generally get my investment back as store credit to buy other cards. The sources I listed are not the only options available on the Internet. There is plenty of other pricing and historical information sources you can use. If you find additional accurate information for forecasting future card prices, feel free to try it out. Analyzing the Data It is challenging to turn quantitative and qualitative data into actionable decisions. I used a few different methods to identify speculation targets. I will cover a couple of ways that you can try as well. Identifying Arbitrage Opportunities One of the best ways to turn a quick profit is finding arbitrage opportunities. Arbitrage is when you buy an item at one price and immediately sell it for a higher price. The most straightforward application of this in MTG finance is purchasing cards at a price lower than a vendor's buylist price. You need to account for transaction fees and shipping to determine your overall profit from arbitrage. I took advantage of an arbitrage opportunity by purchasing copies of Queen Marchesa through Google Express. The website offered a 20% discount for first-time customers. My final price was considerably lower than a vendor's buylist price. Another tactic is digging through bulk boxes at local hobby shops. You may find cards for 0.50 cents that you can buylist or sell for considerably more. Locally, I have seen bulk foil boxes more lucrative than rare bulk boxes due to foil multipliers. Try to pick bulk rares and foils in near-mint condition to maximize returns. Buylist Spreads Cards with buylist spreads around the single percentages are prime targets for speculating. On April 21st, 2019, the spread for Chaos Warp 2017 was 7%, with a buylist price of $2.00. This card is in over 33,000 EDH decks on EDHREC. On TCGPlayer, a vendor was selling a near mint copy for under $2.00 plus $0.76 in shipping. If you can find other cards from this vendor at similarly low prices, you may be able to turn this into an arbitrage opportunity. Spotting Trends Interpreting card price trends is more subjective than spreads or arbitrage opportunities. It would help if you studied demand and pricing shifts to make a decision carefully. Blending qualitative and quantitative information can net better results than strictly looking at historical pricing data. I like finding cards that have bottomed out in price but have recently seen an uptick. I also like cards with upward progression over time, as this tells me I could turn a profit if the card continues seeing upward momentum. I will walk you through my approach for identifying Tithe Taker as a short-term speculation. Identifying a Speculation Target: Tithe Taker

I saw the new Standard Challenger Decks and their decklists on MTG Goldfish. Historically, card prices included in these decks have crashed. However, these decks did not include all of the cards found in tier one decklists. One card missing from the United Assault deck is Tithe Taker. As players buy the United Assault deck, they will likely want to pick up the missing pieces found in competitive decklists. Tithe Taker is an affordable inclusion. I also saw on MTG Goldfish that Tithe Taker's spread was 11% (April 16, 2019) with a slight uptick in price. If I can find cheap copies of Tithe Taker, I may sell a few sets at a higher price. Since this is a Standard card, I want to be in and out of it quicker than cards from other formats. I checked TCGPlayer and found copies at or lower than buylist pricing for sale. I was able to capitalize on different low spread prices from a vendor and bought multiple cards. When I made my purchase, the average cost of Tithe Taker on April 16, 2019, was $1.86, according to MTG Stocks. The average price of Tithe Taker increased to $2.16 on April 21, 2019. Since these cards were all low price pickups, I will need to sell the Tithe Takers as a set on eBay or buylist them with other cards to a vendor. I buylisted three Tithe Takers to Card Kingdom on 5/1/19 for $5.13, a 62% profit of $1.96. In this example, you can see that I used quantitative and qualitative information to make a decision. The qualitative data was my assumption that new Challenger Decks would drive related card prices upward. The quantitative data consisted of reviewing price trends and buylist spreads. I combined my qualitative hypothesis with the quantitative data and decided it was a good purchase opportunity. I searched for the lowest price available and bought a few copies. Lowering Costs It would help if you tried to minimize your total costs associated with buying and selling MTG cards. Any cost incursions will hurt your profit margins. Optimizing a pool of cards on TCGPlayer can lower your shipping costs. Purchasing enough cards from a vendor to receive free shipping is a good idea as well. I recommend taking advantage of TCGPlayer kickback events and eBay promotions when available. These special events can help lower your overall costs of purchasing cards. Another way to earn kickback is through Ebates. Depending on the eBay category, you can receive a 2% cash rebate from MTG-related purchases through Ebates. You may have noticed that I added a column for a cashback credit card in my speculation sheet. When possible, I recommend purchasing MTG cards with a credit card that offers 1.5% or more cashback. The 1.5% can offset costs for buying more MTG cards. Other credit cards with generous points programs are also good options. Just make sure you pay off your monthly balance in full to avoid interest charges. While my goal is to turn a profit from speculating MTG cards, there is still a risk that I will lose money. I will update the speculation sheet information and review selling transactions at the end of May. It will be interesting to see if I can profit from selling cards over the next month. *The information in this article is my knowledge and opinion and is meant for informational purposes only. I am not a registered financial professional or trying to act as one.* Magic: The Gathering finance is a hot topic among players interested in earning a profit from buying and selling collectible trading cards. Trying to understand a collectibles market driven by supply and demand is not always easy. Thankfully, there are resources available on the Internet to help with navigating the dynamic market. The popularity of MTG finance has risen thanks to MTG finance-related podcasts and YouTube channels such as MTG Fast Finance, Cartel Aristocrats, and Alpha Investments. One of the points made by many podcast and YouTube personalities is that they understand that speculating comes with inherent risk. There are plenty of stories and videos of people trying to invest in MTG products to turn a profit but come up short. Speculating involves long and short trading. A long trade is when you buy a trading card today to sell it later at a higher price. This type of speculation is more common than shorting in MTG finance. You can conceptually make a short bet on a trading card by selling it today to repurchase it later at a lower price. I recently buylisted a copy of Vivien Reid from Core 2019 to an online vendor for $24.00 on March 13, 2019. The current selling price for a near-mint copy on April 17, 2019, is $18.99. After free shipping and sales taxes, I will come out ahead if I purchased it back. In my opinion, one of the issues with the MTG financial market is the imbalance of long and short trading. Think about how many articles and videos you have seen recommended buying a card instead of selling a card. It is common knowledge when a Standard card will lose value from rotating, but there is much more uncertainty surrounding the timing of a reprint. Often, people will buy cards that work well with a new reprint by betting that demand for a complete deck will rise. An imbalance in market trading can also give rise to market manipulation. Unfortunately, the MTG market is susceptible to manipulation through card buyouts. It does not take a large sum of money to buy all quantities of an older card from online vendors and websites. A buyout will drive up the price of a card to around the last known purchase price. Sometimes, these buyout price changes are temporary, and the card will retrace back to a level close to its pre-buyout price. More often than not, the costs will hold at the new price or somewhere between the two. It is even more accessible for a group of people to work together and target a specific card. I encourage you to be aware of buyouts and how they may impact your decision-making. I am taking on the challenge of understanding the feasibility of an average player making money on collectible trading cards. My goal is to maximize the cash return from speculating. I plan to use any profits to offset my recent, non-speculative purchases. This multi-post series will use a real-life speculating test to understand the barriers of entry, costs associated with speculating, outlets to sell products, and tactics for spotting trends in the market. I will analyze different steps in buying and selling cards through public transactions across multiple websites. While I believe it is possible to make money speculating, I hypothesize that the potential profit margin will not be worth investing time for the average player. Speculation Spreadsheet Available I purchased almost $200 in MTG trading cards from TCGPlayer, Toy Wiz, and eBay to begin my MTG speculation test. My speculation choices did not come from any form of paywall related to a website, Patreon, or insider information. I made choices based on data available to anyone with Internet access. I created an Excel spreadsheet to track my buys and costs associated with acquiring different MTG cards. You can download a copy of my speculation spreadsheet here. I encourage you to use it and follow price changes throughout this test. Understanding Upfront and Selling Costs

Before analyzing my speculation picks, I wanted to understand the upfront costs of acquiring MTG cards. The fees associated with shipping and sales tax significantly impact the profit margins associated with speculating. When purchasing cards over the Internet, I incurred an average of 10% in additional costs between shipping and state sales tax. I spread shipping and sales taxes among the cards in each relevant transaction. Not only do I have to sell these cards later at a higher price, but I also have to cover the 10% fee hurdle. Another cost incurred was my time to research and buy MTG cards. I spent a total of four hours researching and finding the lowest prices available. There is an opportunity cost of the expenditure time purchasing cards instead of working another job or meeting up with friends. Opportunity costs exist in many forms of financial investing. When you decide to save money for retirement instead of spending it today, you are making an opportunity cost decision. This test will mainly focus on the cost of time versus potential profits in sales dollars. How much money do you expect to make for investing X hours on speculating? This question is something you should ask yourself before investing in MTG cards. The third cost associated with speculating is when you sell a card. While different selling platforms have various fees, eBay charges a 10% to 12% fee for sold listings. In addition, PayPal charges a $0.29 base fee plus 2.9% of the transaction. While the Paypal fees can vary based on your account and sales volume, I am using fees that an average person would pay. Shipping an item with a stamp, hard case, and envelop will cost you 55 cents plus material costs. If you need to use a padded envelope with tracking, PayPal offers a discounted rate starting at $2.67. Add these costs together came to an average of 25% of my final sale price per card. This percentage can fluctuate depending on the sale price and the distance a card needs to be shipped. If you sell a card at $50, the fees will be a lower percentage than another card sold for $20 when shipping with tracking and no insurance. I found that selling a card for $7.50 on eBay is the lowest sale I can make to mail with a stamp. Anything lower than $7.50 will cost me higher than 25% of the final sale price in fees. I would be better off pooling multiple copies of a card together as one transaction, buylisting, or selling locally. As for tracking, my lowest sale price for eBay is $25. I should only mail cards sold over $25 with tracking and a padded envelope. One other risk of selling online is shrinkage from becoming lost in the mail or buyer discrepancies. At a minimum, you should expect a loss of 1% of your total transactions. For example, if you average $20 per card across 100 transactions, you will incur $20 in unforeseen losses. Keep in mind that shrinkage affects your bottom line profit margins. My overall transaction costs were estimated at 35% of the total MTG card costs when buying and selling online. These costs decrease when using a vendor buylist, but you should expect a lower cash offer than if you sold cards directly to a buyer. Also, I did not add a cost for the time it takes to research, purchase, or sell cards. It would help if you tried to find ways to lower transaction costs by receiving free shipping from online orders, buying cards locally from other people, and taking advantage of discount promotions whenever possible. In part 2 of this series, I explain the benchmarks surrounding my card choices and the expected hold periods. I will also touch on different ways to lower transaction costs and purchase prices. To view the other posts in this 3-part series on MTG finance speculation, click the links below: Magic: The Gathering Finance Part 2: Analyzing Speculation Targets and Lowering Costs Magic: The Gathering Finance Part 3: Speculation Hits and Misses After 8 Weeks *The information in this article is of my knowledge and opinion and is for informational purposes only. I am not a registered financial professional or trying to act as one.* |

Follow me

on Instagram @card_knock_life Categories

All

Archives

July 2024

This website contains affiliate links

|

RSS Feed

RSS Feed