|

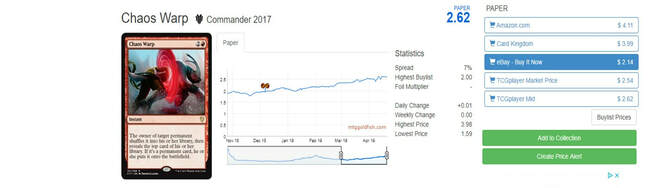

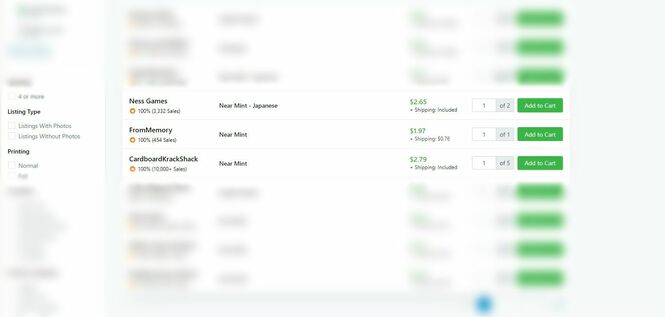

To view the other posts in this 3-part series on MTG finance speculation, click the links below: Magic: The Gathering Finance Part 1: An Introduction and Analytical Test for Speculating Magic: The Gathering Finance Part 3: Speculation Hits and Misses After 8 Weeks Forecasting the price movement of a specific trading card is not a simple task. Business professionals use forecasting models, historical pricing, and qualitative information to make assumptions about the future. Graduate school taught me that a blended forecasting approach is better than using one singular method. While you may not have access to professional forecasting software, there are accessible sources of information about Magic: The Gathering. This information can help you forecast future price movements for MTG card speculating. I am currently running a test on speculating MTG cards, which are available in this spreadsheet. MTG Stocks I like using MTG Stocks to see historical pricing movement, recent price spikes, and track speculations. You can create a free account to watch cards, inventory your speculations, and view the most commonly played cards by format. They have interactive graphs showing price movement over time. MTG Goldfish Another great resource is MTG Goldfish. They also provide graphs of price movement over time. However, the essential information they offer are spreads and buylist prices. I highly encourage you to read this article on MTG Goldfish that explains the metrics available. The format staple lists on MTG Goldfish can help you understand the demand for certain cards across multiple constructed formats. I like reviewing these lists for speculation targets with slow to medium growth potential. MTG Goldfish regularly updates its front page when there are product announcements and spoilers for new cards. eBay Sold Listings Before I purchase a card for speculating, I always check its previous sale prices on eBay. On eBay, you can search for a specific card and filter to sold listings. You should review the conditions and previous prices paid to understand a realistic sale price. I compare the sold eBay pricing with buylists to better understand the spread and demand. EDHREC EDHREC is an excellent source for understanding the general demand of Elder Dragon Highlander (Commander) cards. When speculating on EDH cards, I recommend looking at how many decks a card is listed. Also, check if a card is a recommended option for the most popular commanders. For my speculation test, I looked at cards in 8,000 or more decks. You can consider cards in fewer decks as well. Vendor Buylists Generally speaking, vendors offer about 50% of a card's market value as a cash payment. For cards higher in demand, they may offer cash prices between 60% and 75% of their market value. For example, Card Kingdom offered $10.00 cash for a Guilds of Ravnica Watery Grave on April 20th, 2019. Their sale price for the card was $14.99. The cash buylist price is 67% of their retail price. I like cards with high buylist ratios because it allows me to liquidate closer to my initial investment amount. In addition, the buylist acts as a safety net against my speculations. I can generally get my investment back as store credit to buy other cards. The sources I listed are not the only options available on the Internet. There is plenty of other pricing and historical information sources you can use. If you find additional accurate information for forecasting future card prices, feel free to try it out. Analyzing the Data It is challenging to turn quantitative and qualitative data into actionable decisions. I used a few different methods to identify speculation targets. I will cover a couple of ways that you can try as well. Identifying Arbitrage Opportunities One of the best ways to turn a quick profit is finding arbitrage opportunities. Arbitrage is when you buy an item at one price and immediately sell it for a higher price. The most straightforward application of this in MTG finance is purchasing cards at a price lower than a vendor's buylist price. You need to account for transaction fees and shipping to determine your overall profit from arbitrage. I took advantage of an arbitrage opportunity by purchasing copies of Queen Marchesa through Google Express. The website offered a 20% discount for first-time customers. My final price was considerably lower than a vendor's buylist price. Another tactic is digging through bulk boxes at local hobby shops. You may find cards for 0.50 cents that you can buylist or sell for considerably more. Locally, I have seen bulk foil boxes more lucrative than rare bulk boxes due to foil multipliers. Try to pick bulk rares and foils in near-mint condition to maximize returns. Buylist Spreads Cards with buylist spreads around the single percentages are prime targets for speculating. On April 21st, 2019, the spread for Chaos Warp 2017 was 7%, with a buylist price of $2.00. This card is in over 33,000 EDH decks on EDHREC. On TCGPlayer, a vendor was selling a near mint copy for under $2.00 plus $0.76 in shipping. If you can find other cards from this vendor at similarly low prices, you may be able to turn this into an arbitrage opportunity. Spotting Trends Interpreting card price trends is more subjective than spreads or arbitrage opportunities. It would help if you studied demand and pricing shifts to make a decision carefully. Blending qualitative and quantitative information can net better results than strictly looking at historical pricing data. I like finding cards that have bottomed out in price but have recently seen an uptick. I also like cards with upward progression over time, as this tells me I could turn a profit if the card continues seeing upward momentum. I will walk you through my approach for identifying Tithe Taker as a short-term speculation. Identifying a Speculation Target: Tithe Taker

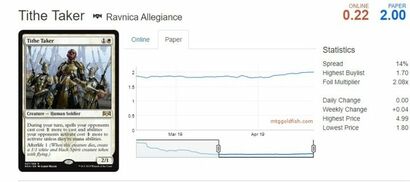

I saw the new Standard Challenger Decks and their decklists on MTG Goldfish. Historically, card prices included in these decks have crashed. However, these decks did not include all of the cards found in tier one decklists. One card missing from the United Assault deck is Tithe Taker. As players buy the United Assault deck, they will likely want to pick up the missing pieces found in competitive decklists. Tithe Taker is an affordable inclusion. I also saw on MTG Goldfish that Tithe Taker's spread was 11% (April 16, 2019) with a slight uptick in price. If I can find cheap copies of Tithe Taker, I may sell a few sets at a higher price. Since this is a Standard card, I want to be in and out of it quicker than cards from other formats. I checked TCGPlayer and found copies at or lower than buylist pricing for sale. I was able to capitalize on different low spread prices from a vendor and bought multiple cards. When I made my purchase, the average cost of Tithe Taker on April 16, 2019, was $1.86, according to MTG Stocks. The average price of Tithe Taker increased to $2.16 on April 21, 2019. Since these cards were all low price pickups, I will need to sell the Tithe Takers as a set on eBay or buylist them with other cards to a vendor. I buylisted three Tithe Takers to Card Kingdom on 5/1/19 for $5.13, a 62% profit of $1.96. In this example, you can see that I used quantitative and qualitative information to make a decision. The qualitative data was my assumption that new Challenger Decks would drive related card prices upward. The quantitative data consisted of reviewing price trends and buylist spreads. I combined my qualitative hypothesis with the quantitative data and decided it was a good purchase opportunity. I searched for the lowest price available and bought a few copies. Lowering Costs It would help if you tried to minimize your total costs associated with buying and selling MTG cards. Any cost incursions will hurt your profit margins. Optimizing a pool of cards on TCGPlayer can lower your shipping costs. Purchasing enough cards from a vendor to receive free shipping is a good idea as well. I recommend taking advantage of TCGPlayer kickback events and eBay promotions when available. These special events can help lower your overall costs of purchasing cards. Another way to earn kickback is through Ebates. Depending on the eBay category, you can receive a 2% cash rebate from MTG-related purchases through Ebates. You may have noticed that I added a column for a cashback credit card in my speculation sheet. When possible, I recommend purchasing MTG cards with a credit card that offers 1.5% or more cashback. The 1.5% can offset costs for buying more MTG cards. Other credit cards with generous points programs are also good options. Just make sure you pay off your monthly balance in full to avoid interest charges. While my goal is to turn a profit from speculating MTG cards, there is still a risk that I will lose money. I will update the speculation sheet information and review selling transactions at the end of May. It will be interesting to see if I can profit from selling cards over the next month. *The information in this article is my knowledge and opinion and is meant for informational purposes only. I am not a registered financial professional or trying to act as one.* Comments are closed.

|

Follow me

on Instagram @card_knock_life Categories

All

Archives

July 2024

This website contains affiliate links

|

RSS Feed

RSS Feed