|

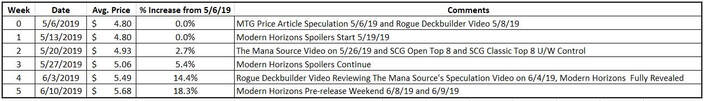

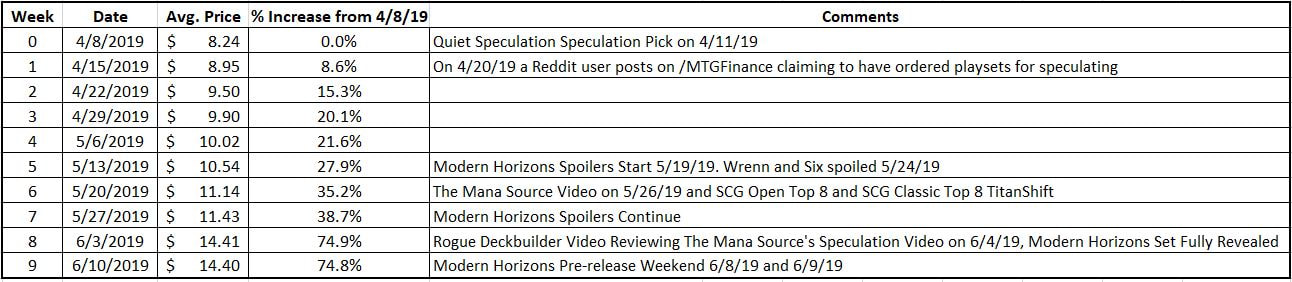

According to www.dictionary.com, "a self-fulfilling prophecy is a prediction that causes itself to be true due to the behavior (including the act of predicting it) of the believer." I have noticed alarming increases in card price movement after Internet personalities and websites share Magic: The Gathering speculations publicly. An article on Quiet Speculation by Sigmund Ausfresser highlighted the dangers of buyouts and price retracing. My takeaway from his article is that artificial demand, fueled by hype, will not hold price increases in the long run. A recent MTG finance-related YouTube video published by The Mana Source has received over 77,000 views since June 11, 2019. The suggested MTG speculations were not all original ideas. Other individuals recommended multiple cards in the video. Following the video's release, I researched price movements for the Return to Ravnica Supreme Verdict and Core 2019 Scapeshift. I wanted to see if these card prices were affected each time an online article or video suggested others to buy them. I used MTG Stocks information to gather historical data on average price changes for Supreme Verdict and Scapeshift. Return to Ravnica Supreme Verdict On May 6, 2019, Travis Allen recommended Supreme Verdict in his weekly article at MTG Price. Allen also co-hosts the MTG Fast Finance podcast. The average price of Supreme Verdict on May 6, 2019, was $4.80. Two days later, Rogue Deckbuilder's Rogue Roundup #14 also recommended Supreme Verdict as speculation. His video had over 3,600 views as of June 11, 2019. The average price of Supreme Verdict remained at $4.80 on May 13, 2019. Over the next week, the average price increased to $4.93. On May 26, 2019, The Mana Source published a video highlighting Supreme Verdict as one of the ten best cards to buy now. The next day, the average price of Supreme Verdict jumped to $5.06. One event worth noting is the Star City Games Modern Open in Louisville, KY, held over Memorial Day weekend. Two copies of Supreme Verdict were in a Blue/White Control top 8 decklist for the Modern Open and Classic. This deck has been a top contender for some time and commonly plays two Supreme Verdict. In addition, Modern Horizons spoiler season was happening before and after the event. It was common knowledge that the set could dramatically change the Modern competitive landscape. Modern players were waiting for the full spoilers of Modern Horizons before making changes to existing decks. While the results of a significant event and spoilers can affect card prices, I believe these events had a negligible impact on the price of Supreme Verdict. By June 3, 2019, the price of Supreme Verdict increased to $5.49. Later that week, on June 4, 2019, Rogue Deckbuilder published a video where he agreed with The Mana Source that Supreme Verdict was an excellent speculation target. Prices continued to climb to the current average price of $5.68 as of June 10, 2019. The average market price for Supreme Verdict increased 18.3% in 5 weeks. Within a week following The Mana Source's video, the average price of Supreme Verdict jumped 12.9% out of the overall 18.3% average price increase during the noted period. Return to Ravnica Supreme Verdict Weekly Average Price Movements 5/6/19 - 6/10/19 Core 2019 Scapeshift On April 11, 2019, an article published by Quiet Speculation highlighted Core 2019 Scapeshift as a speculation target. The average price for Scapeshift on April 8, 2019, was $8.24. By the following Monday, the average price increased 8.6% to $8.95. A few days later, on April 20, 2019, a Reddit user posted about Scapeshift on the MTGFinance subreddit. They claimed to have purchased multiple copies of Scapeshift, specifically the Morningtide version and asked others for input. The post attracted five comments and 15 upvotes. On April 22, 2019, the average price of Scapeshift had increased again to $9.50. I could not find any other mention of the card as a speculation target between April 21, 2019, and May 18, 2019. However, the average price continued increasing to $10.54 on May 13, 2019. By May 20, 2019, the average price of Scapeshift was $11.14, or a 35.2% increase in 6 weeks. During Memorial Day weekend, multiple copies of Scapeshift appeared in the top 8 decks for the Star City Games Louisville Modern Open and Classic. I believe these event results had a minor impact on the price of Scapeshift for the same reasons mentioned about Supreme Verdict. The Mana Source published a video recommending Scapeshift as a speculation target on May 26, 2019. The following day, the average price of Scapeshift was $11.43. Nine days later, Rogue Deckbuilder published his video, agreeing with The Mana Source's recommendation for Scapeshift. As of June 10, 2019, the price of Scapeshift was $14.43, or a 74.8% increase in 9 weeks. It is also worth noting that the average price of Scapeshift increased 36.0% during the 15 days following The Mana Source's video. One theory for Scapeshift maintaining an upward price movement between April 21, 2019, and May 18, 2019, is if Modern Horizons spoiler cards leaked early. Content creators and online personalities received spoiler cards for Modern Horizons before their assigned reveal date. Content creators, or people they chose to share information with, could get an advantage on buying copies of a relevant or synergistic card. One theoretical example could be leaked information regarding Wrenn and Six, a Planeswalker revealed on May 25, 2019. The card has some synergy with Scapeshift. Individuals with early knowledge of Wrenn and Six could buy copies of Scapeshift before new demand drives up the price. Core 2019 Scapeshift weekly Average Price Movements 4/8/19 - 6/10/19 Analyzing and Interpreting the Data

Both Supreme Verdict and Scapeshift have some inherent demand as competitive MTG cards in the Modern format. In addition, the cards get included in Commander decks. Prices will naturally change over time based on player demand and speculation. Players purchase cards found in top deck lists after significant tournaments such as Magic Fests, Mythic Championships, and Star City Games Opens. However, the dramatic price increases over a short period appear to be driven by additional factors. What stands out to me most about the historical price movement is the velocity of price increases. The most significant average price increases for both cards from one week to the next occurred after The Mana Source published a speculation video. While I cannot know the number of people who read written articles, it is clear how many views a YouTube video receives. If 0.5% of the 77,000 views for The Mana Source's video resulted in 1 purchased copy of Scapeshift, that would equate to 385 copies leaving the market. On June 13, 2019, TCGPlayer had 252 copies of Scapeshift for sale across all sets and editions. If people purchased all 252 copies on TCGPlayer, a triggered price spike would likely occur regardless of price. TCGPlayer's copies only account for 65.5% of the demand for 385 copies. Players would have to search other online vendors for any remaining copies to purchase. I believe this simple example illustrates the amount of influence a YouTube channel can have on MTG Finance when they amass as many subscribers as The Mana Source. Rogue Deckbuilder's videos received thousands of views as well. Based on the price trends, I believe that a non-zero number of viewers purchase his recommended speculations. Any time someone with an audience publishes their speculation targets, there is a chance that a viewer will purchase a recommended card. The sample size presented is small as I highlight only two examples of card price movements. However, the price movement related to online videos and articles is compelling. My conclusion is that as audiences grow for an individual's MTG-related financial content, there is a possibility that a self-fulfilling prophecy could occur. Risks Associated with Self-Fulfilling Content There are risks associated with following the advice given by others regarding speculation targets. As seen in the price movements for Supreme Verdict and Scapeshift, the individuals buying cards after the information becomes public risk paying an inflated market price. Those who already own cards before a price spike has the best opportunity to maximize profits. If any of the individuals that published content surrounding the mentioned cards held copies before Memorial Day, they would have made double-digit profit margins selling copies in June. In addition, they would likely have the first chance to sell or buylist at the highest price because of already owning the cards. Other individuals that buy recommended speculations from online vendors must wait for their cards to arrive in the mail or visit a local hobby store. I assume any time a content creator or individual publicly recommends an MTG speculation target, they already own multiple copies of that card and want to see it increase in value. There is an additional risk for buying cards after a price spike due to price retracing. The individuals who bought and sold the cards last have a higher likelihood of losing money. I touched on price retracing surrounding the buyout of Queen Marchesa in a previous article. The average market price for the card before its buyout was $19.99. After the buyout, the average price moved to $38.97 on April 8, 2019. Any individuals who already owned the card could have sold it for a healthy profit or buylisted to Card Kingdom for $24.00. As of June 13, 2019, the average market price of Queen Marchesa is $28.08 with a buylist price of $12.00. When factoring 20% of the sale price as fees and shipping, the net price for selling a Queen Marchesa online now is $22.46. Any copies of Queen Marchesa purchased for the average market price after April 6, 2019, will lose money when sold today. *The information in this article is my knowledge and opinion and is meant for informational purposes only. I am not a registered financial professional or trying to act as one.* Comments are closed.

|

Follow me

on Instagram @card_knock_life Categories

All

Archives

July 2024

This website contains affiliate links

|

RSS Feed

RSS Feed