|

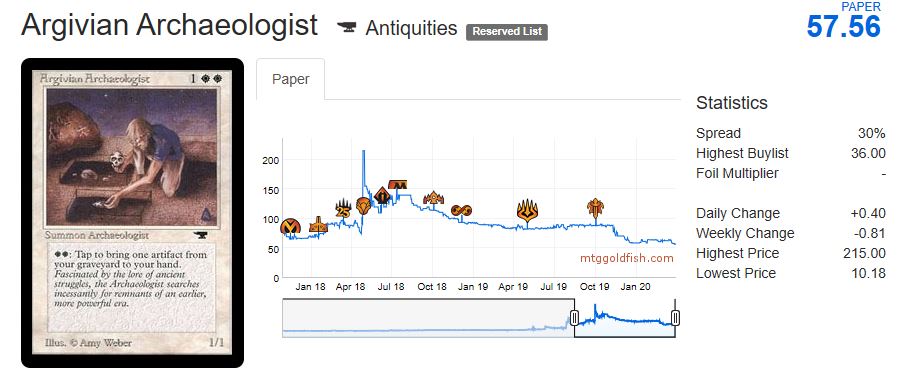

Magic: The Gathering contains a primary and secondary market. Products sold through a distribution network are part of the primary market. The secondary market consists of buying and selling individual trading cards open from sealed products. It also contains selling sealed products sold outside of distribution networks like out of print booster boxes. The secondary market of MTG is an unregulated space where buyers and sellers exchange goods. Market behaviors found in regulated markets, such as the Nasdaq stock market, can also exist in MTG's secondary market. One such economic event that can occur in both markets is known as a market bubble. Investopedia defines a bubble as "an economic cycle characterized by the rapid escalation of asset prices followed by contraction. It is created by a surge in asset prices unwarranted by the fundamentals of the asset and driven by exuberant market behavior." A recent article by Elvis Picardo highlights the five largest asset bubbles in history. The dotcom bubble of the 1990s occurred in the Nasdaq market. One of the most famous bubbles was Tulipmania. This particular bubble occurred during the 1630s in Holland The market bubbles in MTG's history are not as evident as Tulipmania. How is a bubble identified in a market containing trading cards? This article explores some possible occurrences of bubbles in the secondary market. Individual Card BubblesIn MTG, buyouts of individual cards could lead to a price bubble. This article on buyouts in MTG lists several examples. Specifically, the price history of Hexdrinker shows a brief period of rapid escalation in July of 2019, followed by a correction within 90 days. Another card that potentially went through a price bubble is Argivian Archaeologist. This card from the Antiquities set was almost $70 in January 2018. It saw a price increase that hovered between $120 and $140 by the summer of 2018. Unfortunately, the price fell to about $60 by the end of 2019. Other cards with similar price movements include Gaea's Cradle, Tolarian Academy, Candelabra of Tawnos, Ali From Cairo, and Drop of Honey. All of these cards appear on MTG's reserved list. Throughout 2018, there was a heightened interest in purchasing cards on MTG's reserved list. Reserved list cards potentially experienced a market bubble that began in 2018. MTG Set BubblesMany valuable cards on the reserved list are from MTG's earliest sets. One such set is Legends, which released in 1994. The price for Legends increased by 65% in early 2018 from $9,370 to $15,476. During 2019, the set's price fell about 22% to around $12,000. By January 31st, 2019, the set had dropped further in value to $9,666. Antiquities, another set from 1994, dramatically increased 90% from $2,415 to $4,586 in 2018. The price declined by about 12% and stabilized around $4,000 during 2019. Antiquities pricing fell further by 17% between October 2019 and January 2020. Similar price patterns occurred for the Arabian Nights set as well. Market bubbles can occur over a short or lengthy period. It is hard to predict when a bubble may happen and for how long. Buyouts are also hard to see coming. One option to avoid losing money on a potential bubble is not buying cards after spiking in price. While some cards stabilize at a price above pre-buyout levels, this is not guaranteed. Anyone who owns the cards before a price spike can potentially make money. However, there is likely a limited amount of time to make a profit.

*The information in this article is of my own knowledge and opinion. It is meant for informational purposes only. I am not a registered financial professional or trying to act as one.* Comments are closed.

|

Follow me

on Instagram @card_knock_life Categories

All

Archives

July 2024

This website contains affiliate links

|

RSS Feed

RSS Feed