|

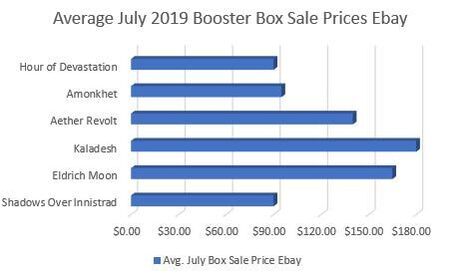

In Magic: The Gathering, Standard format booster boxes contain 36 packs of trading cards. Each pack contains 15 individual cards, with one at the rare or mythic rarity. In addition, there is a 1:67 chance to open premium foil versions of cards (changed to 1:45 in Core 2020). Some of the older sets also contain foil lottery cards with unique art. MTG Dawnglare is a website that tracks the average estimated value (EV) of MTG sets and individual packs. The set EV on MTG Dawnglare multiples a set's current pack EV by 36. In other words, this EV is the average expected value found in a booster box. EV can change over time as individual cards in a set move up and down in price. Booster box market prices can differ from set EV because other factors, such as supply and demand, can impact booster box market pricing in addition to set EV. Current Prices for Rotated Standard Booster Boxes In this evaluation, I am covering sets that rotated out of Standard in October 2018. You can download a copy of the data file here. My reasoning for using rotated Standard sets is because current Standard booster box prices remain relatively constant while they print to demand. I am rounding box prices to whole numbers for the sake of easy math. The following graphic shows current market prices for sealed booster boxes of previous Standard sets. The average sale price for Shadows Over Innistrad and Hour of Devastation is $90.00. Amonkhet is selling for $95.00. There is a large gap between the prices for these sets and the others shown. Kaladesh, Aether Revolt, and Eldritch Moon sell for $180.00, $140.00, and $165.00, respectively. What I find interesting is the market price of a sealed booster box compared to the value of its contents. Sealed booster boxes carry a price premium relative to the EV of individual packs. A few reasons players would pay a premium for out-of-print booster boxes include drafting, collecting, and investing. To understand if current booster box pricing is warranted, I compared it against the set EV. I used the default set EV values on MTG Dawnglare, which references TCG Player Mid. The following graphic shows these comparisons. The gold line across the graphic shows the average July booster box prices on eBay. The blue bars show current set EVs. The biggest takeaway from this graphic is where the gold line is respective to the top of each set's blue bar. Compared to other sets, Aether Revolt and Hour of Devastation booster boxes appear underpriced. On the other hand, Kaladesh and Eldritch Moon booster boxes seem overpriced. Since the sample size is small, I would look for additional data to support selling Kaladesh booster boxes and buying Aether Revolt booster boxes. Analyzing Rotated Standard Booster Box Growth and Profitability

When looking at current prices, all rotated Standard booster boxes have appreciated over time. Shadows Over Innistrad, Amonkhet, and Hour of Devastation have increased the least. They also have the lowest values among set EVs. The monthly average growth of the top three booster boxes far outpaces the bottom three. Since their release, the average increase per month of the top-performing booster boxes has been $2.00 or higher. The increase equates to an estimated 12-month return of at least 30.0%. However, the growth of these boxes most likely occurred toward the end of their print cycle through today. If you assume booster boxes remained at $80.00 while in print for the first 12 months of availability, then the average growth per month would be higher than $2.00. While 30.0% is a strong return, it is not necessary the net return for selling booster boxes. Since booster boxes are physical assets, you must mail or personally deliver them to a potential buyer. If you use an online platform to sell your booster boxes, you may pay a seller transaction fee. In this evaluation, I used the USPS Priority Mail medium flat rate box as the shipping method of choice. You may find cheaper rates through other delivery methods or by utilizing a business account. I also calculated the fees for selling on eBay as 12.9%, including the 10% eBay and 2.9% Paypal fees. I purposely omitted the $0.29 additional transaction fee on Paypal for simplicity. When adding the shipping costs and expenses together, you can expect a minimum transaction cost of $24.41 on a $90.00 booster box through eBay. Unfortunately, these costs equate to 27.1% of the sale price. This high percentage means that selling one booster box of Shadows Over Innistrad, Amonkhet, or Hour of Devastation is unprofitable on eBay. You would need to sell these booster boxes locally, through other Internet platforms, or as a bundle with discounted shipping to earn a profit. I calculated the breakeven amounts for selling booster boxes on eBay. To earn a profit of 0.0% on an $80.00 booster box, you will need to sell it for $106.54, or essentially a 33.2% return on investment. If you paid $90.00 for a booster box, you would need to sell it for $118.03 to net 0.0% profit. The return on investment at 0.0% on a $90.00 box is 31.1%. It is clear in these calculations that shipping prices are detrimental to profit margins. Every $1.00 saved on shipping costs for a $90.00 sale price will lower your transaction costs by about 1.1%. These estimates may differ from your actual shipping options and fees. However, selling one booster box at a higher price point can yield higher returns. Shipping is arguably a fixed cost since each Standard booster box has the same size and weight. The net return on selling a Kaladesh booster box on eBay at $180.00 is 80.0%. Eldritch Moon's net return is 63.6%, followed by Aether Revolt's net return at 36.4%. Assuming you sold one of each $80.00 rotated Standard set booster box on eBay to different buyers, you would have earned a net profit of $105.16 or 21.9%. Risk and Opportunity Cost Investing in booster boxes is not without risk. Supply and demand for these collectible products affect prices. In addition, booster boxes are physical assets that must be stored and protected. Any accidental damage to a sealed booster box can negatively impact its value. A holding cost may become relevant if you have to pay for storage space. However, the riskiness of holding booster boxes can pay off with potential double-digit returns. Investment vehicles with negligible risks, such as Certificate of Deposits and Money Market accounts, would produce lower returns than the evaluated booster boxes in totality. Current CD rates on Bankrate show the annual percentage yield (APY) offered at one and two years fall between 2.50% and 2.70%. This article on balance highlights the returns of other risky investment options over 10, 5, and 3-year periods. I want to draw attention to the 3-year returns since the average hold period in the evaluation was two years and eight months. You can see that the only investment vehicle with similar returns to the overall rotated Standard booster boxes was the S&P 500 Index. While I do not know the actual risk level for MTG booster box investing, I would compare it to the riskiness of purchasing stocks. My takeaway is that the evaluated booster boxes outperformed other investment vehicles with less riskiness. Summation Before investing in any product, I always think about my level of risk tolerance. Booster boxes do not seem to be a short-term investment (under a year). While they appear relatively easy to liquidate, the transaction fees can be steep. However, the returns calculated in this analysis match closest (after estimated costs) to the S&P 500 Index during a similar period. Due to the overall results of this evaluation, I believe MTG booster boxes can be a good investment vehicle when held in a diverse portfolio. *The information in this article is my knowledge and opinion and is meant for informational purposes only. I am not a registered financial professional or trying to act as one.* Comments are closed.

|

Follow me

on Instagram @card_knock_life Categories

All

Archives

July 2024

This website contains affiliate links

|

RSS Feed

RSS Feed